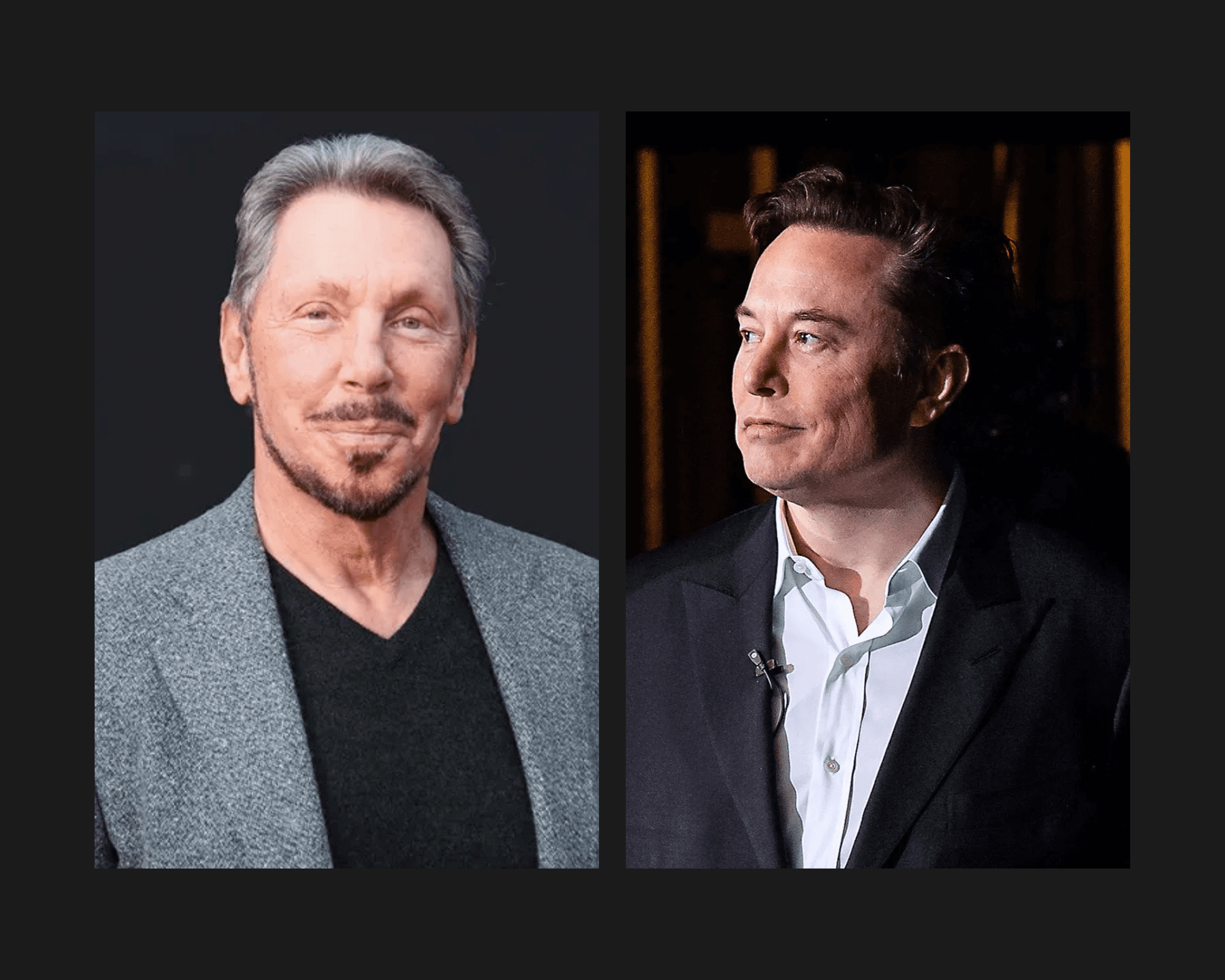

The Moment Everyone’s Talking About

Larry Ellison has officially overtaken Elon Musk to become the world’s richest person, and the internet cannot get enough of it. What happened? Oracle, the company Ellison co-founded decades ago, reported blockbuster earnings that sent its stock soaring by more than 40 percent in a single day. The result was staggering. Ellison’s net worth jumped by over 100 billion dollars overnight, pushing him to a record 393 billion dollars.

Elon Musk, once the untouchable king of the billionaire rankings, slipped into second place with a still massive 385 billion dollars. The sudden flip of positions sparked a wave of buzz, not only across financial markets but also all over social media feeds, where memes, hot takes, and debates about the “new richest man” took center stage.

The Internet Reacts

Whenever wealth rankings shift, people talk. But this one felt different. It was not just about one billionaire beating another. It was about how artificial intelligence, cloud computing, and long-term contracts are suddenly more powerful wealth drivers than rockets or electric cars. Twitter, Reddit, and LinkedIn lit up with commentary. Some hailed Ellison as the quiet visionary who played the long game. Others wondered if Musk’s more volatile approach is showing cracks. Either way, the conversation is louder than ever.

The Numbers That Broke Records

Let’s break it down clearly:

- Larry Ellison’s net worth: 393 billion dollars

- Elon Musk’s net worth: 385 billion dollars

- Oracle stock surge: 40 percent in a single day

- Largest one-day gain in Bloomberg Billionaires Index history: 100 billion dollars added to Ellison’s fortune

For context, here is the updated billionaire leaderboard as of September 2025:

| Rank | Name | Net Worth | Main Companies |

|---|---|---|---|

| 1 | Larry Ellison | $393B | Oracle |

| 2 | Elon Musk | $385B | Tesla, SpaceX |

| 3 | Mark Zuckerberg | $253B | Meta (Facebook) |

| 4 | Jeff Bezos | $241B | Amazon |

Why It Matters Beyond the Rankings

It is easy to look at this as another billionaire shuffle, but there is more here. Ellison’s win highlights the way markets are rewarding AI and cloud infrastructure as the backbone of the next decade. Oracle is not the flashiest company, but it is suddenly the one shaping the future of enterprise technology.

Musk, meanwhile, continues to innovate in electric vehicles and space exploration. His companies remain revolutionary. But the market is speaking clearly: right now, steady contracts, AI infrastructure, and enterprise-level solutions are seen as more valuable than hype-driven disruption.

Social Buzz and Cultural Takeaways

One of the reasons this story caught fire online is because it is about personalities as much as it is about business. Musk is a constant lightning rod for attention, with millions following his every move. Ellison, in contrast, has often stayed quieter, playing the role of the reserved titan. His sudden leap to number one created a narrative twist that people love to dissect.

Social media platforms flooded with memes comparing Oracle’s rise to Musk’s rollercoaster ride. Analysts weighed in with serious takes about the role of AI in wealth creation. Everyday users debated whether Ellison’s wealth is a sign of smart patience or simply the luck of timing. In the world of online conversation, it became less about the specific dollar amounts and more about what those fortunes represent in 2025.

Lessons for the Modern Business Landscape

Ellison’s ascent carries lessons that ripple far beyond billionaire gossip.

AI Is the Center of Gravity

Artificial intelligence has moved from buzzword to main driver of market value. Oracle’s surge was tied directly to AI infrastructure, the systems powering global business. Companies across industries are watching this moment closely, realizing that AI adoption is no longer optional.

Long-Term Contracts Trump Volatility

Oracle’s record gains came from multi-year agreements with major clients. These contracts gave investors confidence and drove the massive stock surge. Musk’s companies thrive on bold vision and disruption, but the stability of Oracle’s approach proved more appealing to markets in this moment.

Reputation and Patience Pay Off

Ellison’s decision to keep his large Oracle stake magnified his gains when the stock jumped. His patience paid off in spectacular fashion. For businesses and entrepreneurs, it is a reminder that sometimes the slow, steady play can beat the flashier gamble.

A Broader Cultural Moment

Ellison’s rise to number one is not just a business headline. It is a cultural moment reflecting how the internet and global markets now overlap. Business news no longer lives only in financial journals. It explodes across platforms where everyday people weigh in with jokes, takes, and critiques. Wealth leadership today is part of the online conversation, shaping public perception of what success looks like.

For many, Musk still embodies the bold, risky spirit of modern innovation. For others, Ellison now represents the strategist who positioned himself for the AI revolution. The debate itself is what keeps this story alive.

Conclusion

Larry Ellison’s leap past Elon Musk to become the world’s richest man is more than just a headline. It is a snapshot of where global business is headed and what markets value most in 2025. Artificial intelligence and cloud infrastructure have replaced rockets and electric cars as the engines of wealth creation, at least for now.

The internet is buzzing, investors are recalculating, and business leaders are taking notes. Ellison’s story is a reminder that the future of wealth is not always about the loudest visionary, but often about the strategist who quietly built the backbone of tomorrow’s economy. And right now, the world cannot stop talking about it.

Comments are closed